Homeowners selling or refinancing their homes, and planning their next purchase, need to know the true value of their property. With changing market conditions and buyer demand, customary valuations can feel slow and confusing. The ability to develop Instant Home Valuation can benefit such homeowners, as it allows fast assessment of market value, enabling homeowners to make a decision at the right time without losing money.

Instant valuation tools use data, technology and market behavior to provide results in seconds. This gives homeowners the ability to weigh their options without the inconvenience or complications of a prolonged process. It gives them a leg up when it comes to negotiating deals, or simply comparing with real estate trends in the moment. With competitive housing markets, speed is everything.

The Basics and Importance of Instant Home Valuation

Instant Home Valuation has automated home value evaluations based on real estate-related sets of data that includes real estate trends and market conditions that affect values, such as location, size, sold prices in the area, neighborhoods, etc., allowing homeowners quick estimates of their overall home values and preparation for financial decisions. Due to their simplicity, they have replaced several property evaluation methods in some jurisdictions.

Customary home valuation requires appointments, inspections and long wait times. Instant valuation allows homeowners to be in control of their time. It provides immediate information without a commitment, allowing the user to ascertain their own property's potential and thus providing a more informed starting point.

Traditional Appraisal vs. Instant Home Valuation

|

Feature |

Traditional Appraisal |

Instant Home Valuation |

|---|---|---|

|

Processing Time |

Requires appointment and inspection |

Delivers results within seconds |

|

Cost |

Often requires a fee |

Usually free and accessible |

|

Convenience |

Limited to scheduled visits |

Available anytime from any device |

|

Data Source |

Physical inspection |

Automated market and property data |

Instant valuations provide the condition of the property and help real estate conversations and negotiations. This provides homeowners with more accurate outcomes and a faster solution when looking for a mortgage.

Key Elements Behind Accurate Instant Home Valuation Tools

Instant valuation tools use data analysis, market research, and automated programs to generate property estimates, which homeowners should know how to interpret properly. Reliable Instant Home Valuation systems rely on state-of-the-art technology and provide fast, accurate, and trustworthy results.

Data Sources and Algorithm Structure

Instant valuations use a range of data sources, including nearby sales, ownership records, tax assessments, and location information, which are used by algorithms to compare with similar properties in the area to determine market value. The accuracy of the results is generally better if the data are up to date.

Predicted values may be adjusted by property characteristics (lot size, building condition, number of rooms, improvements) or market conditions. Property valuations are regularly updated to maintain accuracy with real estate market changes. This dynamic process helps homeowners understand how much their property may appreciate.

Market Trends and Local Factors

Neighborhood desirability, school districts, community amenities, proximity to other communities, and growth rates are all inputs to local real estate pricing. Instant valuation systems analyze these variables to determine pricing patterns and arrive at numbers that reflect true market activity.

Prices are also affected by local supply and demand: growing demand causes housing prices. As supply outpaces demand, the pressure on prices abates and this can be seen in such instant valuations, allowing homeowners to make informed decisions.

Comparing Instant Home Valuation with Other Valuation Methods

Homeowners have several options, from instant online valuations that are fast and easy to thorough appraisals performed by professionals who inspect the property in its entirety. Understanding market analysis, and the difference from other methods realtors use to discuss the market, can help a person choose.

The Instant Home Valuation is more useful during the early planning stages of your project, while formal appraisals are most useful in obtaining final loan approvals and legal purposes. Comparative market analysis is more useful for sellers in estimating competition.

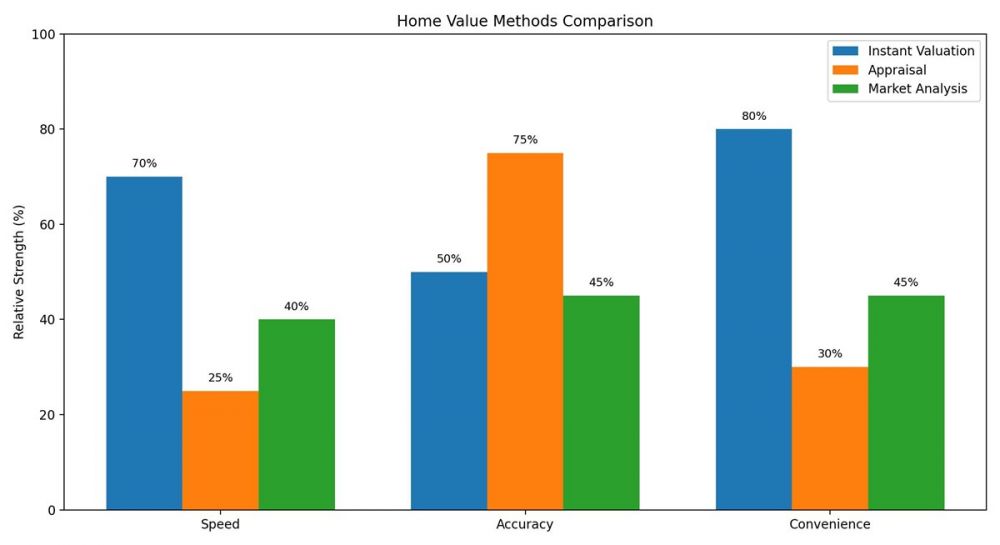

Comparison of Valuation Methods

- Instant valuation is the fastest (70%) and most convenient (80%) option.

- Customary appraisal is 75% accurate and the best choice for formal assessments.

- Market analysis in general is not specialized, but is spread evenly across all categories.

- Appraisals take longer (25% speed) due to the need for scheduling and inspection.

For example, during a refinance, a homeowner can receive an automated valuation that instantly estimates equity. In preparation for selling, a homeowner creates an instant valuation before contacting an agent for a more thorough valuation. A buyer considering multiple houses may prefer to see an estimated value and seek advice from an expert.

Instant valuation tools are a good first step but should be followed with next steps and planning. Instant valuations are better used in conjunction with other information as part of the decision..

Practical Steps for Using Instant Valuation Effectively

An instant home valuation can be used effectively by homeowners when following the right steps, helping the homeowner determine the financial potential of their home, supporting their planning, and helping them in negotiating with buyers, agents, and lenders.

The first step is to have the property information accurate for reliable results. You should then check and adjust the records. Then, carefully analyze your valuation report and check for other potentially influential factors such as lot size and sold prices.

- Provide accurate home details to improve estimate quality.

- Compare valuation results with local market trends.

- Use valuation as a starting point before making commitments.

- Discuss results with real estate experts when needed.

With these steps, homeowners have a clear picture of property value, and instant valuation can help short- and long-term decisions.

Why Instant Home Valuation Supports Smarter Planning

With William Reynoso, homeowners are given reliable estimates of the value of their homes so they can make informed choices with instant results and financially sound choices. The tool uses data analytics, market trends, and automated tools to provide instant valuation that captures current housing market conditions.

Tools like these give buyers confidence during uncertain times, ease early decision making, and prepare homeowners for deeper conversations with agents. An instant valuation is a good start. But if selling, refinancing, remortgaging or investing, it's even better with professional help.