Purchasing a home is a big money move, which means it has to be considered very carefully. This applies even more if you are buying in a hard real estate market. The mortgage calculator FL is a great device that gives the buyers a clear picture of their monthly instalments, how much out of the total will be the interest, and what the financial obligations will be in the long run. Using the mortgage calculator when purchasing a home is a means of setting a fair account of the possible outcome and is also a step in getting ready for the lenders' talks. This tool is indispensable for anyone planning to buy a house in Florida.

Planning a mortgage is not just about different payments estimations. Buyers need to think of taxes, insurance, interest rates, and the type of the house. A Homes mortgage calculator FL is a tool that deals with all these details and gives the users results that are both quick and accurate. It allows buyers to identify terms of the loans and different financial situations. The decision-making process in such a situation becomes quite simple and well-organized.

Florida’s property market is a place where different buyers come; first-time buyers, investors, and seasonal residents. Every group will benefit from the understanding of mortgage liabilities. This post starts with the basics of mortgage planning, goes into the details of mortgage calculations, makes comparisons with different methods, gives practical tips, and ends up with a summary to help make a confident decision.

Understanding Mortgage Basics and Their Importance

A mortgage is basically a big money deal that lasts for a long time between the buyer and the bank. It is a combination of the loan amount, rate of interest, duration of the loan, taxes, and insurance. Knowing these things will help the buyers to make a good plan.

Usually, mortgage payments stem from four parts: principal, interest, taxes, and insurance. Each part needs to be looked at by the buyers to understand how much they will have to pay for one month altogether. Property taxes in Florida and insurance are going to be different depending on where you are, so being accurate in your plan is very important. A mortgage calculator is a great tool to clear up these kinds of situations.

Factors Influencing Mortgage Payments

|

Factor |

Impact on Payment |

Importance |

|---|---|---|

|

Interest Rate |

Higher rates increase monthly payments |

Major influence on long-term affordability |

|

Loan Term |

Longer terms reduce monthly payments |

Affects total interest paid over time |

|

Property Taxes |

Adds to the monthly mortgage amount |

Important for location-based financial planning |

|

Insurance Costs |

Increases the required monthly payment |

Vital for risk assessment and coverage evaluation |

Understanding mortgage basics helps buyers prepare financially. By evaluating core factors, they gain control over their home-buying journey and avoid unnecessary surprises.

Detailed Components Behind Accurate Mortgage Calculations

The Homes Mortgage Calculator FL gathers the information from different points to create the close to the real figures. Prospective buyers can gain, through the detailed understanding, how each element influences the total of their liabilities. By having such information, they can check the feasibility of the loan and compare different credit options while being assured of their choice.

Significant Inputs Considered in Mortgage Estimation

To estimate mortgages, calculators take into account fundamental data that affect the price of the house, the amount given as a down payment, the interest rate, the length of the credit period, the taxes, and the insurance. The price of the house is the main factor that decides the size of the loan. If the buyer gives a larger down payment, that means the loan amount is smaller, which results in lower monthly payments. In fact, a change in the interest rate causes a substantial difference in the total cost of the debt over time.

The period for which one opts for a mortgage

A 15-year or a 30-year loan, for instance, decides how the payments will be scheduled. The shorter the term, the less total interest will be paid, but the monthly payments will be higher. On the contrary, a longer period will make your monthly payments affordable, but in the end, you will have to pay more. For that reason, taxes and insurance should be considered as well if one wants to make the calculations with absolute accuracy, especially in Florida, where the rates are different in each county.

The calculator combines these factors using an amortization formula

It separates each payment into principal and interest portions. Gradually, the interest portion becomes smaller and the principal larger. This change in the balance affects, among other things, the growth of the equity and the buyer's financial planning.

Consumers are allowed to experiment with various situations to determine the results. By way of instance, they can show how altering the amount of the down payment would restructure the loan. Changing interest rates can be used to demonstrate how timing is of the essence.

Comparing Mortgage Planning Methods and Real Results

Buyers employ various methods to figure out the amount of their mortgage payments. Some of them perform the calculations by themselves, while others seek the advice of a lender. The Homes Mortgage Calculator FL is a way that is both quicker and more trustworthy.

Manual calculations depend on complex formulas and are prone to mistakes. They have very limited capabilities when it comes to testing different scenarios. Guidance from a lender is tailored to the customer's needs but may require some waiting time. Mortgage calculators are a perfect combination of quickness and correctness.

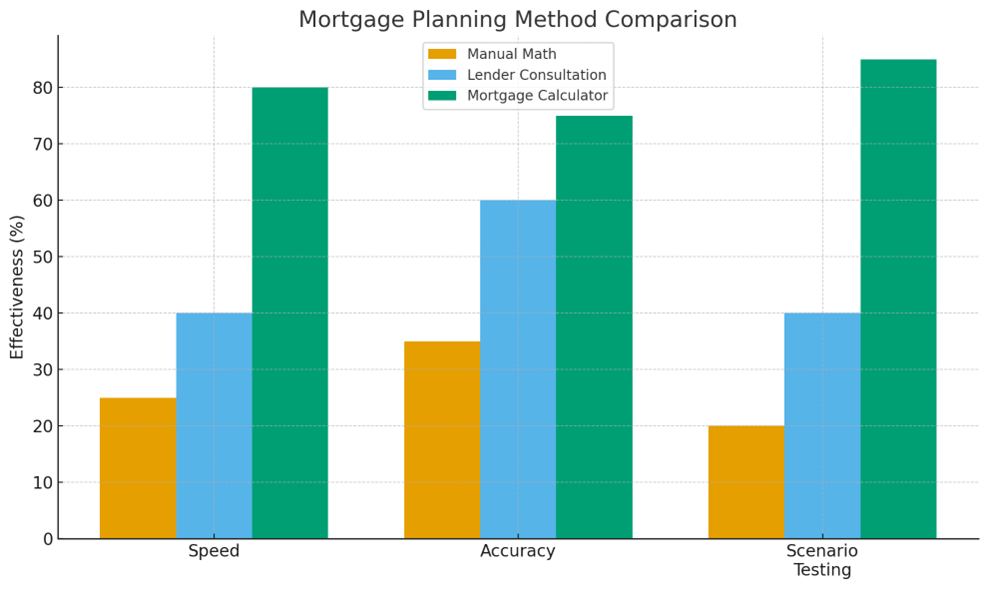

- Mortgage calculators outperform all other methods, offering the fastest speed, highest accuracy, and best scenario testing.

- Manual math scores lowest, showing limitations in speed and precision for real mortgage planning.

- Lender consultations perform moderately, improving accuracy but still falling behind automated calculator tools.

- Scenario testing sees the largest gap, with calculators offering far greater flexibility for comparing rates and loan terms.

Such comparisons are the reasons why mortgage calculators provide huge benefits in terms of planning and decision-making. They make buyers get ready with confidence and lessen the risk of financial uncertainty.

Practical Tips for Using a Mortgage Calculator Effectively

The Homes Mortgage Calculator FL is a tool that buyers use to improve their chances of getting the right mortgage. They can make this tool more effective by giving correct details and by trying out different situations. As a result, they get a clear plan and can even anticipate what the lender will say.

First of all, get real data like the price of the house, the amount of the down payment you will make, and the average local taxes. These numbers are what guarantee the results to be reliable. After that, try out various loan terms. For instance, a comparison of 15-year and 30-year alternatives helps determine where the money will be saved in the long run or what the level of affordability is.

Here is a brief list of the best practices:

- Use correct data describing the property and your finances.

- Check out different loan terms to see which one fits your budget best.

- Experiment with more than one interest rate scenario.

- Do not forget taxes and insurance if you want your figures to be accurate.

Thinking ahead Buyers must think about what kind of changes might be in their lives and how that would affect their loan. For example, prepayment can significantly reduce the amount of interest payable in the long run. In such cases, mortgage calculators serve as a handy tool to foresee these results. It is definitely more efficient and also a bargaining tool to see the figures and then talking with lenders.

Why Mortgage Calculators Support Smarter Home Buying

With William Reynoso, using The Homes Mortgage Calculator FL should be on the top list of tools for a new home buyer in Florida. It is an absolute necessity as it takes the complicated financial details and returns quick and accurate figures. When a buyer knows all the ins and outs of the mortgage, they end up making the right choices and do not get surprised by hidden obstacles. Calculators support planning, comparison, and future financial strategies.

Mortgage planning becomes easier when buyers understand interest rates, loan terms, taxes, and insurance. Calculators bring these elements together in one simple system. This helps buyers evaluate affordability, prepare for lender discussions, and create realistic budgets.

The right planning tools empower buyers. They help create clarity in a competitive market and support long-term financial stability. With the mortgage calculator, buyers gain confidence as they move closer to home ownership.